Automatic NetSuite Cash Reconciliation

Completely automate NetSuite bank reconciliation. Payments, refunds, and disputes are automatically reconciled to a bank deposit record when Stripe notifies the integration that the funds have settled.

Right now, your cash reconciliation process most likely looks something like this:

- Export a CSV or report from your merchant gateway

- Import into Excel and figure out when transactions were originally processed based on the card type.

- Open up the deposit screen in NetSuite and attempt to select the transactions that were included in the bank deposit.

- Use the gateway reports to calculate the credit card processing fees, and other fees that may been issued against your account.

- If disputes/chargebacks were included in the day's batch deposit, manually create records in NetSuite and calculate total fees.

- If you have multiple merchant accounts, multiple currencies, of slight variances between NetSuite payments and your settlement report, etc there are probably quite a few more steps!

SuiteSync completely automates this process. Bank deposits are created each business day without any manual work.

Here's a short video walkthrough:

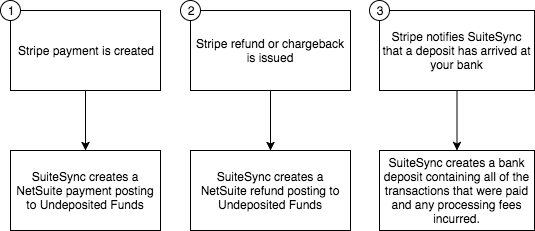

Here's a written description of how it works:

- SuiteSync creates payments and refunds for each transaction created in Stripe. These transactions post to the "Undeposited Funds" account in NetSuite.

- Stripe notifies SuiteSync that a payout (aka batch payment, transfer) has successfully arrived at your bank.

- SuiteSync creates a bank deposit record in NetSuite. The deposit contains all of the payments, refunds, and chargebacks contained in that day's bank deposit. Any processing fees, currency conversion fees, dispute fees, refunds for any fees, etc are calculated and included as separate line items posting to expense accounts that you choose.

This is an automated process that occurs every day. SuiteSync ensures that the deposit total and the date of the deposit match exactly what appears on your bank statement. Cash reconciliation is as simple as matching the bank deposit record to the deposit on your bank statement!

Here's a visual overview: